Multifactor Authentication for Real Estate Appraisers

Cybersecurity threats are more prevalent than ever with a new hack announced what seems like every other day. Real estate appraisers are not immune to these risks. With the increasing reliance on digital platforms, protecting sensitive information is crucial. One of the most effective ways to enhance security is through multifactor authentication (MFA).

What is Multifactor Authentication?

Multifactor authentication is an additional security measure that requires users to provide more than one form of verification to access a system, network, or application. This can include a combination of passwords, one-time codes sent via SMS or email, biometric data such as fingerprints or facial recognition, and security questions.

Why is MFA Essential for Real Estate Appraisers?

1. Enhanced Security

MFA adds an extra layer of security to protect against unauthorized access to sensitive information. Even if a password is compromised, the additional verification step prevents hackers from gaining access.

2. Compliance with Regulations

Implementing MFA helps real estate businesses comply with legal and regulatory requirements, such as data protection laws and industry standards.

3. Protection of Client Information

MFA ensures that client data, including financial and personal information, is protected from unauthorized access, fostering trust and maintaining a competitive edge in the digital marketplace.

4. Prevention of Financial Loss

Cyber breaches can result in significant financial losses. MFA helps prevent these breaches by making it more difficult for attackers to access sensitive information.

Types of Multifactor Authentication

1. SMS Token Authentication

A one-time code is sent to the user’s mobile device via SMS, which must be entered to gain access.

2. Email Token Authentication

Similar to SMS token authentication, but the one-time code is sent via email.

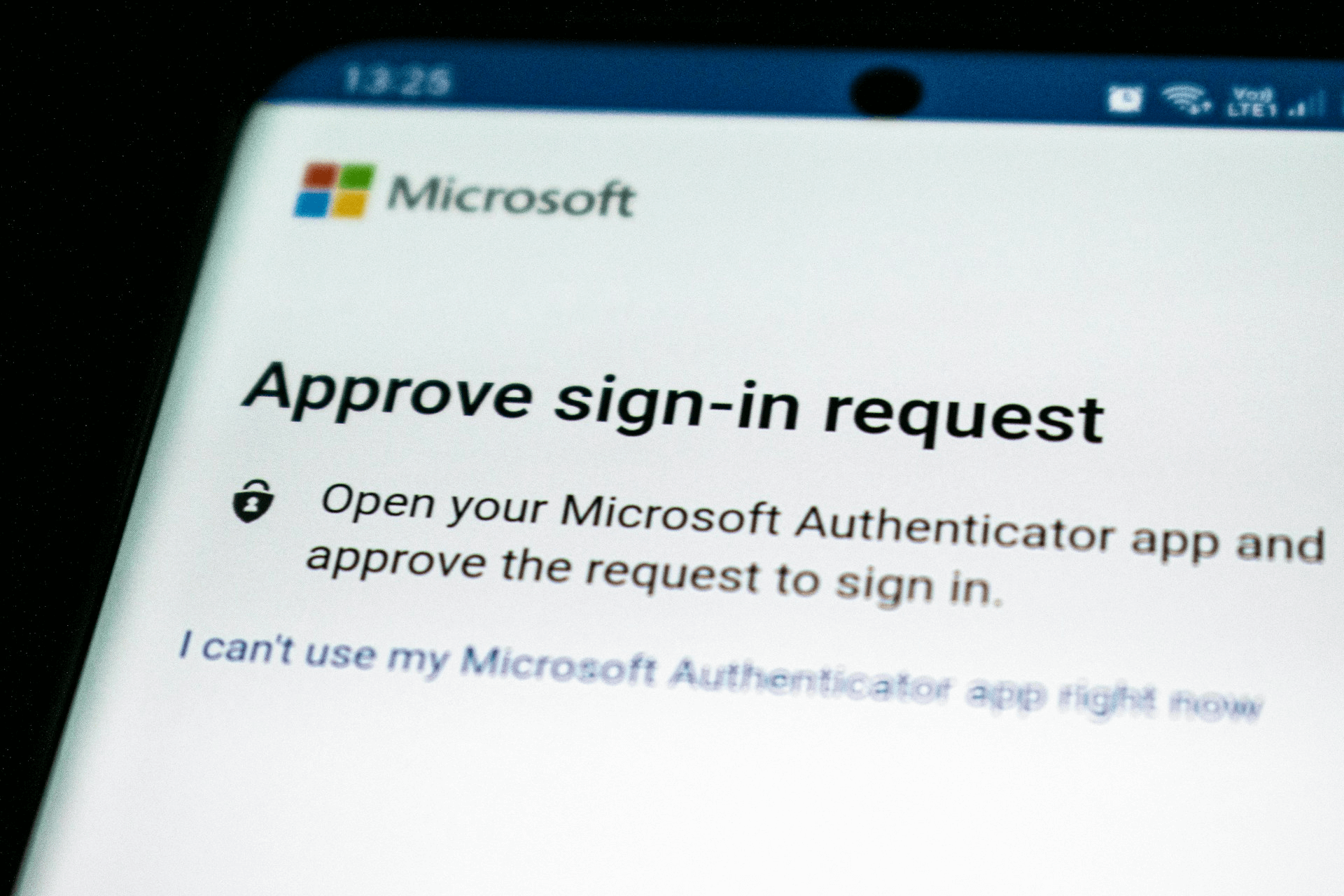

3. Authenticator Apps

Apps like Google Authenticator, Okta, and PingOne provide a prompted switch or code for verification.

4. Biometric Authentication

Uses unique personal features, such as facial or fingerprint recognition, to verify identity.

5. Security Questions

Requires users to answer specific questions to verify their identity, though this method is considered less secure due to the ease of researching answers.

Best Practices for Implementing MFA

1. Choose a Secure and Reliable Authentication Method

Select methods that offer a high level of security, such as MFA or biometric authentication.

2. Regularly Update and Review Authentication Processes

Stay updated with the latest advancements in authentication technology and regularly review and update processes to address emerging security vulnerabilities.

3. Educate Stakeholders on the Importance of Authentication

Provide training and education to employees, clients, and partners on the significance of MFA to create awareness and promote a culture of security.

By implementing multifactor authentication, real estate appraisers and appraisal teams can significantly enhance the security of their digital platforms, protect sensitive information, and maintain trust with their clients.

For more tips on enhancing your online security, check out our guide on antivirus software for real estate appraisers, email security best practices for real estate appraisers and password security and management for real estate appraisers.

Recent Posts

Feature Spotlight: File Number Configuration

Discover how Appraisal Inbox's File Number Configuration automates consistent file numbering for app...

Read moreFeature Spotlight: Two-Way Sync for Google & Outlook Calendars

Sync appraisal schedules automatically between Appraisal Inbox, Google Calendar, and Microsoft Outlo...

Read moreFeature Spotlight: Portal Push

Discover how Portal Push eliminates manual data entry, saving appraisers hours of time with one-clic...

Read more